Car repossession is a stressful experience that no one wants to face. This article aims to walk you through the different stages of car repossession and offer practical tips to manage the situation effectively. By the end, you’ll know what to expect, how to protect your rights, and how to move on if repossession occurs.

What is Car Repossession?

Car repossession happens when you default on your car loan. The lender then takes back the vehicle. Usually, this occurs after a grace period, following one or more missed payments.

Stages of Car Repossession

Missed Payments

You miss a payment and receive a warning from the lender.

Grace Period

Some contracts offer a grace period to catch up.

Default

After the grace period, you’re in default.

Tips for Those Facing Repossession

Talk to Your Lender

Open a line of communication. Try to negotiate new payment terms.

Know Your Rights

Read your contract and state laws. Some states require prior notice before repossession.

How to Get a Car After Repossession

Having a car repossessed affects your credit score. But you can still get another vehicle. A co-signer, a significant down payment, or specialized “bad credit” lenders can help.

How the Car Repossession Process Works: From Default to Auction

The process of physically repossessing a car varies by jurisdiction and lender policies, but here’s a general outline:

- Authorization: Once you’re in default, the lender authorizes a repossession agent to retrieve the vehicle.

- Locating the Car: The repossession agent uses various methods to locate your vehicle. This could involve tracking devices, public records, or even social media.

- Seizure: Once found, the agent will seize the car. This usually happens without prior notice and can occur at any location where the car is publicly accessible—home, workplace, or even a public parking lot.

- Inventory and Storage: After repossession, agents typically inventory personal items found in the car and store them. You’ll usually be notified and given a chance to reclaim these items.

- Notification: Many states require the lender to notify you after repossession. This often includes information on how to redeem the car or reinstate the loan, if applicable.

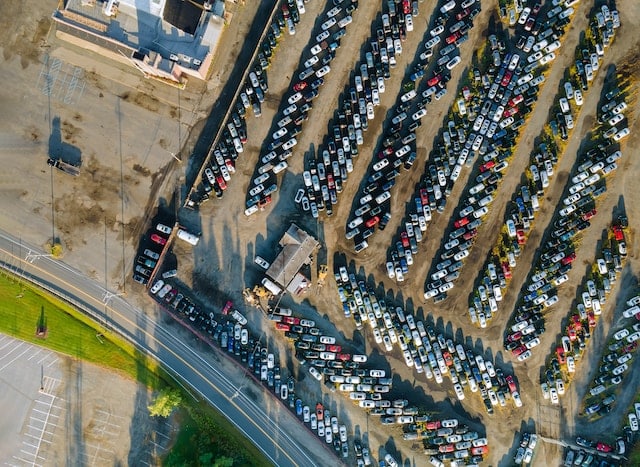

- Auction or Resale: The lender will often sell the repossessed vehicle at an auction or through private sale to recover as much of the outstanding loan as possible.

Note that most contracts stipulate that the lender can repossess without breaching the peace. This means agents can’t use physical force or enter private property without permission. If you believe the repossession wasn’t carried out properly, consult an attorney for advice.

Car Repossession Legal Steps

Consult an Attorney

Get legal advice if you believe your rights have been violated.

Document Everything

Keep records of all interactions with the lender.

Legal Timeframes in the Car Repossession Process

The legal timeframes for taking action after car repossession can vary widely depending on your state’s laws and your loan contract. However, here are some general ranges:

- Notice and Cure Period: Some states require lenders to offer a “cure” period after repossession, usually between 15 to 30 days. This is your chance to catch up on payments.

- Redemption Period: After the car is repossessed and before it’s sold, you may have a limited window to redeem it by paying off the loan in full. This period can range from a few days to a couple of weeks.

- Deficiency Judgment: If the car sells for less than the remaining loan balance, the lender may pursue a deficiency judgment. Timeframes to contest this can vary, often between 30 to 60 days.

- Legal Claims: If you believe your rights were violated during the repossession, consult an attorney immediately. Statutes of limitations for filing such claims can vary, often ranging from 1 to 6 years.

Always consult your loan agreement and local laws to understand the specific timeframes that apply to your situation.

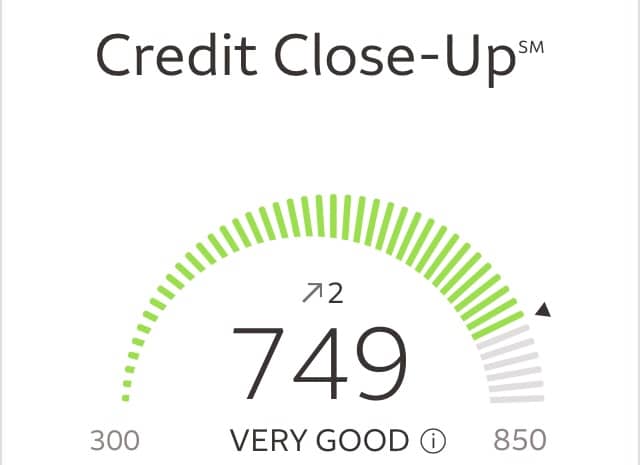

The Varying Impact of Car Repossession on Credit Scores

The impact of a car repossession on a credit score can vary significantly depending on various factors such as the individual’s starting credit score, their overall credit profile, and whether or not the repossession is the only negative item on their report. Credit scoring models like FICO and VantageScore don’t publicly disclose the exact algorithms they use, but various financial experts and resources have made some general estimates:

- High Credit Score (720 and above): A car repossession can have a significant impact on a high credit score, potentially dropping it by 100 points or more. Individuals with high scores often have more to lose and can see a more significant drop.

- Good Credit Score (690-719): A repossession is likely to drop a good credit score by around 60-80 points. However, the impact could be larger if the repossession is accompanied by other negatives like missed payments.

- Fair or Average Credit (630-689): A repossession can have a somewhat smaller proportional impact but will still usually result in a decline of around 50-70 points.

- Poor Credit (300-629): While a repossession will still hurt a poor credit score, the absolute decline might be somewhat less simply because there’s less room for the score to fall. Still, expect a drop of 30-50 points or more.

Remember that a repossession stays on a credit report for seven years, and its impact will lessen over time if you manage your credit responsibly going forward. However, during the period immediately following the repossession, obtaining new credit can be more challenging and expensive due to higher interest rates and stricter approval guidelines.

It’s worth noting that these figures are general estimates, and individual experiences can vary widely. For personalized advice, consult a financial advisor or credit counselor.

Navigating Car Repossession: Effective Negotiation Strategies

Facing car repossession is stressful, but you’re not powerless. Knowing how to negotiate can make a big difference. Whether you’re trying to keep your car or minimize financial damage, these tips can help.

- Contact Lender Early: Reach out before you miss a payment.

- Be Honest: Explain your financial situation clearly.

- Know Your Rights: Research repossession laws in your state.

- Ask for Options: Inquire about deferment or loan modification.

- Get it in Writing: Document any agreed-upon changes.

- Consult Legal Aid: Seek legal advice if needed.

- Avoid Voluntary Repossession: It still impacts your credit.

- Sell the Car: Consider selling and paying off the debt.

- Reinstate the Loan: If allowed, catch up on payments and fees.

- Negotiate Terms: Try to lower your monthly payments.

By following these quick tips, you can navigate the complex process of car repossession and find a way to keep your vehicle or minimize the financial impact.

Car Repossession FAQ

What is car repossession?

Car repossession occurs when a lender takes back a vehicle due to missed loan payments.

What are the stages of car repossession?

The stages are: missed payments, a grace period, and default. After default, the lender can repossess the vehicle.

Can I negotiate with my lender?

Yes, you can and should talk to your lender. You may be able to negotiate new payment terms to avoid repossession.

Do I have any legal rights during repossession?

Yes, your rights vary by state and contract terms. Some states require the lender to notify you before repossessing the vehicle.

How does repossession affect my credit score?

Repossession has a negative impact on your credit score, making it harder to get future loans.

Can I get another car after repossession?

Yes, although it’s more challenging. Options include using a co-signer, making a large down payment, or seeking a “bad credit” loan.

Should I consult an attorney?

If you believe your rights have been violated, or you’re unclear about the legal aspects, it’s advisable to consult an attorney.

What should I document?

Keep records of all interactions with your lender and any payments made to protect your interests.

Is it possible to recover from a repossession?

Yes, understanding the process and your rights can help you make informed decisions for future financial stability, including securing another vehicle.